Our services to fit your business needs

Focus on human outcomes and measure significant success in your financial services delivery with online customer acquisitions and competitive CX

Ensure business agility and speed up time-to-value with the unparalleled remodeling of your back-office services and infrastructure technology solutions

Affect your customers with the sharpest product ideas cut through a stagnant market and powered by emerging technologies and payments innovations

Work faster and smarter, grow your core business and harness new partnerships while we fully support you on the IT front as a technology partner

Become a trusted payments provider and eliminate resource-draining integrations through establishing an efficient ecosystem of payment gateway APIs

Increase service efficiencies and eliminate the risk of cybersecurity breaches by ensuring your products are fully compliant with the payments industry regulations

Monetize data, launch a holistic business management process, and actualize your products and services in the value chain through analytics-powered insights

Areas of expertise

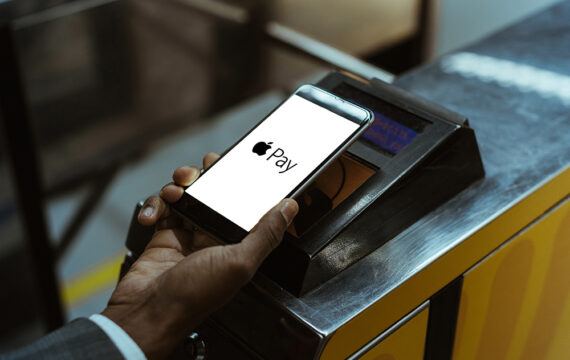

From credit card consulting to contactless payment services and e-wallets, many emerging avenues of payment revenue are up for grabs. Our payments consulting team can help you unlock those new value opportunities. Slash your operating margins with new payment gateway integrations and payments cooperatives. Drive extra profits through mobile wallet offerings and data monetization. Enable credit card payments processing in bulk at a lower cost with modern, resilient online payment solutions and scale your core business with our payment processing technology expertise.

Payment gateway development

Facilitate payments across all digital channels and retain ownership of the customer experience by creating a rich ecosystem of payments technologies

Online payment systems

Work with our systems integration specialists and payments advisors to create pioneering and efficient online payments products that are customer-centric and fully secure

Digital wallet development

Allow your customers to complete payments the way they want to boost loyalty and profits. Accelerate your mobile wallet development initiatives with our technical guidance on transaction processing

POS software development

It’s time to upgrade your POS terminal! Speed up checkout, integrate loyalty programs, and create data-rich customer profiles with new-gen POS system software

Recurring billing software

Deliver a seamless recurring billing experience for your customers. Minimize friction and maximize efficiency with a new billing subscription module for a credit card company

Payments security

Make sure your custom payment solution meets PCI DSS compliance requirements and has anti-fraud systems for EMV, swipe, and card-not-present payments